Small businesses around the world have been especially vulnerable to this crisis. Image sourced from Bloomberg News.

Today marked the beginning of the second application period for loans under the Paycheck Protection Program. After the initial $350 billion in support was depleted in less than a week, US government approved an additional round of funding and is presently considering a third. These loans are intended to support small businesses that have suffered due to restrictions put in place to combat the current pandemic.

Some note that program’s guidelines have made it possible for additional businesses to be overlooked despite the fact that they are small and in dire need of assistance. One such group are US subsidiaries of foreign companies. How the US decides to aid companies in this class—and how foreign countries decide to treat subsidiaries of US companies—will have effects on local communities as well as diplomatic relations.

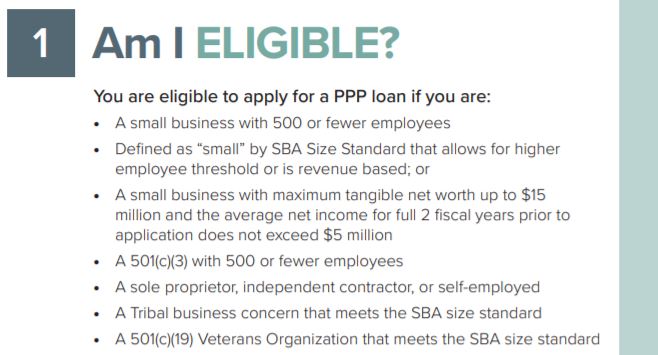

Government-backed PPP loans are intended to help small businesses who are suffering due to national restrictions brought on by Covid-19. Payments are deferred for 6 months with the total not being due for two years. They’re forgivable, even up to the maximum amount—$10 million. According the SBA website, those eligible for this assistance must meet the following guidelines:

What does this mean for small businesses that happen to be subsidiaries of foreign companies?

Owners of companies fitting this description can breathe a sigh of relief—at least for the time being. Per the SBA’s guidelines on what constitutes a “small business concern,” subsidiaries and affiliates of foreign companies are generally are allowed to request assistance, as long as they meet the size requirements listed above. Companies are only excluded from this kind of assistance when they are a joint venture with the foreign entity having more than 49% ownership.

The US federal government’s decision to allow foreign owned subsidiaries to apply for aid, assuming they meet requirements, has benefits on the local level as well. States like Illinois, Texas, and Virginia have seen a rise in foreign direct investment. Additionally, foreign companies that expand to the US hire American workers. According to the TradePost USA, 7.4 million Americans were employed by foreign-owned companies in 2017, up 2% from the year prior. International business doesn’t only happen in high-level corporate settings. Sometimes it’s the business next door that employs your neighbor or family member.

Is the same courtesy extended elsewhere?

The answer to this is yes, in some cases. Unsurprisingly, the US has signed tax-treaties with a long list of countries around the world. Each agreement has its own unique details, meaning varying treatment for US subsidiaries.

French Finance Minister Bruno Le Maire arrives at the Palace Elysée. Image sourced from EPA/Christophe Petit Tesson.

France, for example, is home to a number of US companies. It’s longstanding agreements have made it an attractive destination for American firms. In line with its socialist traditions, this country has been on the more generous side of small business assistance. Under France’s assistance program, referred to as fonds de solidarité, qualifying businesses were initially eligible for up to 1,500 a month in assistance. Recently, that number has been expanded to between 2,000, and 5,000 for extreme circumstances. In contrast to the one-time loans in the US, the French Ministry of Finance has approved these monthly payments for as along as the country is on lockdown. Companies are eligible for this assistance so long as they meet size requirements and can prove that they either 1) were forced to close due to government restrictions, or 2) suffered a decline in sales due to the pandemic. This requirement is slightly more selective than in the US, where companies do not need to prove they had closed or missed out on earnings in order to qualify for a loan.

Only companies with their financial headquarters located in tax havens are expressly prevented from accessing this aid. Eligibility requirements for the fonds de solidarité focus on size and capital, not corporate citizenship. This is to say that subsidiaries of American companies based in the country are eligible for the same assistance as French companies.

Small businesses are the bedrock of all major economies, whether they are homegrown or foreign affiliated. Closures due to the current pandemic have caused great economic hardship, especially for small and midsize enterprises. Government officials in the US and around the world are implementing programs to keep them afloat.

Stay tuned for further analysis of other countries’ responses to small businesses in need of assistance.

Is your company a small business affected by the current economic slowdown? Business owners and executives reviewing their current strategies may benefit from our self-assessment tool. Initially designed for international projects, this pdf makes sure all aspects of the business are covered. Download it for free at the bottom of our Services page.

Upon request, free online consultations will be available to executives who use the self-assessment and might still need some help. The economic impact of this pandemic is global. We contribute our expertise in international business to make a difference because we are all in this together.

Use this FREE self-assessment to check if your company has everything it needs to go global.

Learn more about how we can make your

market development a success, in the U.S. or in another country.